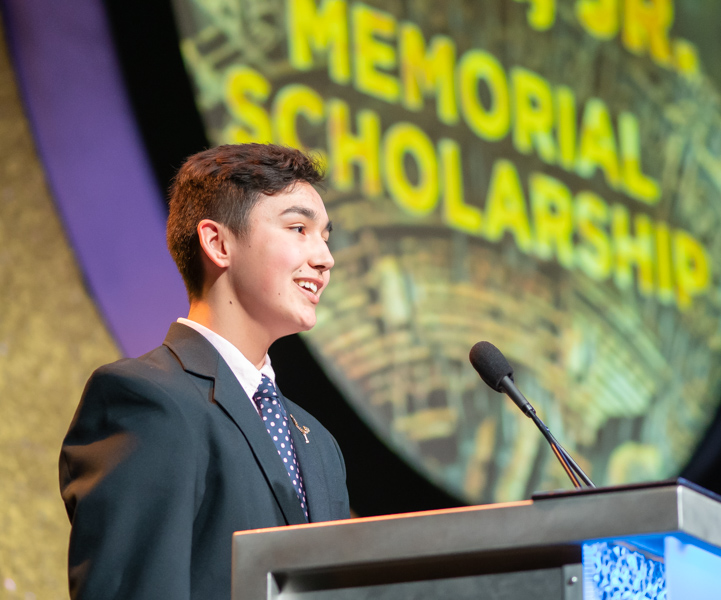

SUPPORT DECA

MAKE AN IMPACT

When you donate to Washington DECA, you are impacting hundreds of students in leadership and providing them opportunities to develop their skills and contribute to the future of Washington. There are many ways you can leave your mark on DECA, so check out what works best for you!

OTHER WAYS TO CONTRIBUTE

See if your company participates in a matching program!

Companies big and small participate in matching programs.

Contact your Human Resources, Corporate Giving or Community Relations team for more information on how you can double your impact.

Wondering what to do with your old car, boat, RV, or motorcycle?

Consider donating it to Washington DECA. Donating is easy, the pick-up is free, and your gift is tax-deductible. This is an easy way to take care of your unwanted vehicle and make a charitable gift! Call 855.500.RIDE or click below to schedule your motor vehicle donation today.

Leave a Legacy.

As you consider the role that Washington DECA has played in helping develop our future community and business leaders—or perhaps you are an alum and you recognize the positive impact that DECA has had upon your life—we invite you to make a transformational gift by incorporating Washington DECA into your estate plan.

All assets, including cash, securities, real estate, and tangible personal property, may be transferred to Washington DECA through your estate. If you have named Washington DECA in your estate plan, we ask that you please contact us so we may know your wishes and recognize your generosity.

Please consult with your lawyer or estate planning professional to help you determine the option that works best for you and your situation. If you need to speak to a member of the Washington DECA team, contact emily@wadeca.org.

Estate gifts include any of the following:

Bequests

A bequest made through your will or living trust allows you to direct how your belongings will be distributed to your family, friends, and charities. Through a bequest, you have the ability to make a gift to Washington DECA in the future, while preserving your assets during your lifetime. Bequests to Washington DECA can take a variety of forms, and if your life circumstances change, you have the flexibility to adjust your gift through a simple amendment. In addition, you may receive valuable estate tax savings.

Retirement Plan Assets

A gift that does not require you to change your will is to designate Washington DECA as a beneficiary of your retirement plan assets through your account beneficiary designation form. Naming Washington DECA as a beneficiary of your retirement plan has the added advantage of being among the most tax-wise ways to make an estate gift. You can leave other types of assets such as cash,appreciated securities, or real estate to your heirs, and direct tax-burdened assets to a tax-exempt charitable institution like Washington DECA.

Life Insurance Policies

Did you know you can use a life insurance policy to support your interests? You can designate Washington DECA as the sole beneficiary or in combination with family members as the beneficiary of a life insurance policy. Alternatively, you can transfer ownership of a paid-up policy to Washington DECA during your lifetime and receive an income tax charitable deduction.

Financial Accounts

You can also name us on your savings, checking, money market, investment accounts or commercial annuities by completing a form with your bank or the originating institution, stating that the funds are to be distributed to Washington DECA upon your passing.

Charitable Trusts

You can transform Washington DECA and its role in developing emerging leaders while achieving your own personal and financial goals. A charitable remainder trust, provides payments for life or a term of years that can supplement your retirement income or provide support for family members and friends. A trust can also provide tax benefits, such as an income tax deduction, avoidance of capital gains tax with a contribution of an appreciated asset, and a reduction in estate tax.